Discover myAL myShare 2023

The myAL myShare 2023 offer is an opportunity to participate in the Group’s development by becoming a Shareholder or expanding your share portfolio on preferential terms.

Why invest in Air Liquide?

Air Liquide’s strength is driven by the resilience of its business model, the diversity of its business lines, its various geographic locations and its ability to innovate for almost every sector of the economy. The Group draws on these robust foundations to continue to drive its long-term growth momentum and contribute to a more sustainable world.

A strong long-term performance

The ADVANCE strategic plan, which was launched in March 2022, consolidates these advantages and places Air Liquide on track to achieve a global performance by combining financial performance with non-financial performance.

For the past 20 years, the share price has risen steadily and paid dividends to its Shareholders(1). By regularly reinvesting your dividends in Air Liquide shares, you can build a portfolio capable, for example, of financing a personal project.

Key datas

Group revenue in 2022: €29,934M |

Net profit (Group share): €2,759M |

Dividend per share proposed at the Annual General Meeting of May 3, 2023: €2.95 |

|

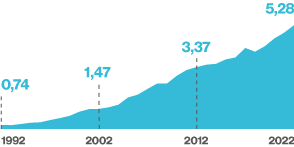

Evolution of adjusted net earnings per share over 30 years (in euros): +6.8% average annual growth(2)  |

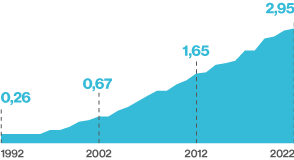

Evolution of adjusted dividend(3) per share over 30 years (in euros): +8.4% average annual growth(2)  |

Air Liquide share growth (+52.50%) compared to the CAC 40 index (+21.86%) over the past five years: ~ 2.5 x greater |

|

WHY SUBSCRIBE TO THE MYAL MYSHARE 2023 OFFER?

| A 20% discount The subscription price will be determined based on a reference price equal to the average opening trading prices of Air Liquide’s shares over the 20 trading days preceding the date the subscription price is set by the CEO. A 20% discount is then applied to this reference price: this is the subscription price. |

Payment facilities You may pay for your subscription in full upfront or spread your payment over 12 months through an interest-free payroll deduction (each monthly payment is capped at 10% of your net monthly remuneration)(4) depending on the local offer conditions. |

BECOMING A DIRECT REGISTERED SHAREHOLDER: WHAT ARE THE ADVANTAGES?

|

1 share = 1 voting right You are part of your Group’s decision making process by voting at the General Meeting. |

10% loyalty bonus on dividends after two years. You will be eligible to receive the dividend voted on by Shareholders during the General Meeting each year, plus a 10% loyalty bonus once you have owned your shares for two years. |

|

+ 10% on the number of shares when free shares are attributed to all Shareholders These attributions also benefit from the 10% loyalty bonus for all shares you have owned for two years or more. |

No handling fees Your direct registered share account will be directly managed by the experts at Air Liquide’s Shareholder Services Department, without any financial intermediary. |

Subscription conditions

WHO CAN SUBSCRIBE?

All employees of an Air Liquide Group company that is a member of the IGSPP (International Group Share Purchase Plan), and with at least three months of employment(5) within the company on the closing date of the subscription period, i.e. on November 16, 2023 (based on the indicative calendar). The three months of employment must fall between January 1, 2022 and November 16, 2023.

HOW TO PAY FOR YOUR SUBSCRIPTION?

Details of the methods of payment available to you can be found in your country’s local supplement which can be obtained in the “Download documents” section of this website.

How much must I invest?

You are free to invest as much or as little as you wish.

Minimum: 1 share

Maximum(5): 25% of your estimated gross annual remuneration for 2023.

If you pay via a payroll deduction, each monthly payment is capped at 10% of your net monthly remuneration.

HOW TO SUBSCRIBE IN JUST A FEW CLICKS?

1 Click on the “Subscribe to myAL myShare 2023” button

- This will take you to the subscription website

2 If you have received your access codes by email:

- Click on “I would like to retrieve my password”

- Enter your access code and the email address at which you received this code (note that this access code is specific to this offer only!)

- A temporary password will be sent to you by email and you must choose a new personalized password the next time you connect

3 If you have received your access codes by mail:

- Log in with the access code and password sent to you by mail (note that these login details are specific to this offer only!)

- Create a new personalized password when prompted by the website

4 Complete the subscription screen:

- Check your personal information and correct it where necessary,

- State the number of shares you wish to purchase and your preferred method of payment.

5 Validate your subscription:

- You will receive confirmation by email

- Your subscription cannot be canceled once the subscription period has ended

Indicative calendar(6)

October 30, 2023:

Subscription price setting

From November 6 to 16, 2023:

Subscription period

December 7, 2023:

Capital increase and creation of your shares

(1) Any investment in shares carries a risk of capital loss. Past performances of Air Liquide’s shares are not a guarantee of future results. This does not constitute financial investment advice. You may consult the risk factors mentioned in the Universal Registration Document, available at airliquide.com.

(2) Calculated according to prevailing rules over 30 years.(3) Dividend per share paid the following year based on the current year's results. Adjusted for the 2-for-1 share split in 2007, for free shares attributions and for the capital increase completed in October 2016(4) This method of payment depends on the conditions in your country. Details of the methods of payment available to you can be found in your country’s local supplement which can be obtained in the “Download documents” section.

(5) This criterion may vary according to the conditions applicable to your country.(6) Subject to the decision of François Jackow, CEO of Air Liquide, to implement the offer.